The RMAI Board of Directors spent time in Washington this month meeting with federal agencies, congressional offices, and legislative committees to share industry insight and discuss emerging policy issues. These conversations helped outline priorities for the coming year, reinforce responsible industry practices, and strengthen relationships across Capitol Hill at a time of significant transition in consumer finance, technology, and compliance.

A central discussion involved the CPFB, where leadership described imminent operational and political uncertainty. With only weeks of funding remaining, a temporary shutdown is likely unless courts or Congress act. Growing partisan divides around structural reforms may complicate any short-term solution. In a meeting with the Acting Director of the CFPB, RMAI focused on the complaint portal. RMAI raised concerns about its placement on the CFPB’s homepage and abuse of the portal, and the agency acknowledged the challenges of making technical and legal updates. RMAI discussed possible improvements, including enhanced validation requirements for submissions through the portal. CFPB signaled openness to refining the portal while preparing contingency plans if operations pause.

Engagements with the FTC, OCC, and FCC highlighted each agency’s priorities. The FTC emphasized fraud-related enforcement, including scams, phantom debt, and impersonation, and expressed interest in recent changes to federal fraud-reporting pathways. The OCC centered its discussion on supervisory policy, requesting feedback on existing guidance and exploring how credit reporting and capital treatment intersect with debt sales. The FCC addressed robocall and caller-ID accuracy rulemakings and noted growing interest in digital communication tools such as texting and email as outreach norms evolve.

Capitol Hill conversations surfaced consistent themes. Many offices raised uncertainty about the CFPB’s future and discussed potential structural reforms and additional guardrails to maintain core consumer-protection functions. Committees highlighted economic priorities for 2026 that include capital formation, regulatory relief, market structure, illicit finance, crypto currency, and small-business lending. Additional issues such as medical debt, fraud reporting, and financial literacy appeared regularly. RMAI certification was discussed throughout the meetings and received strong support, with encouragement to continue its growth and evolution as market conditions change.

Artificial intelligence also received widespread attention. Committees focused on technology, financial services, and oversight expressed interest in balanced federal approaches, preemption policy, and self-regulatory frameworks.

Soon after these meetings concluded, Congress released text of the 2026 National Defense Authorization Act. A moratorium on state AI regulation was not included despite recent negotiations. As we write this, an Executive Order is expected in the coming days.

RMAI monitors, tracks, and responds to legislative and regulatory activity in all 50 states as the need arises. Backed by RMAI’s State Legislative Committee and a team of state lobbyists, RMAI educates legislators and regulators about the industry and the negative impacts or unintended consequences a bill would have on businesses and consumers. If you have an interest in volunteering in RMAI’s grassroots advocacy efforts, please contact RMAI General Counsel & Senior Director of Government Affairs David Reid at (916) 779-2492 or [email protected].

RMAI is synonymous with our governmental advocacy initiatives – it is one of the pillars which our association has been built upon – fighting for the interests of our members. Our association has been blessed with an unparalleled level of success in amending and stopping harmful legislation. A good measure of our success has come from the volunteer efforts of RMAI’s state legislative committee and the generosity of our members to the Legislative Fund which helps pay for our lobbying efforts.

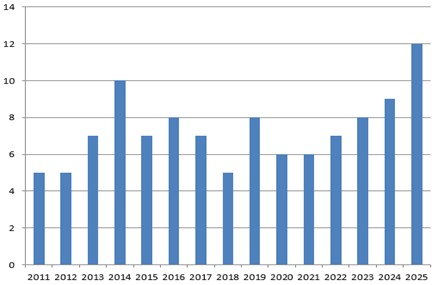

In 2025, RMAI retained 12 state lobbyists . . . a record for RMAI.

In 2026, RMAI expects to see significant increased state legislative activity in the area of artificial intelligence as well as continued heightened activity related to laws impacting medical debt, wage and bank garnishment, collection and litigation restrictions, coerced debt, consumer notices, among other issues. How can you help? Last week, RMAI Committee Interest Forms were shared with the membership for 2026 committee assignments. Please consider joining our efforts in protecting the industry at the grassroots level by joining the State Legislative Committee.

Together we will continue to make a difference!

Eleventh Circuit Rejects Browserwrap, Clickwrap, and Double Opt-In Arguments

Valiente v. Nexgen Glob., LLC, No. 23-13308, 2025 U.S. App. LEXIS 29465 (11th Cir. Nov. 10, 2025)

A consumer alleged that a company, from which he purchased products online, violated the Telephone Consumer Protection Act and the Florida Telephone Solicitation Act by subsequently sending him unsolicited telemarketing messages without prior express consent.

The company filed a motion to compel arbitration, explaining the steps the consumer took in purchasing its products:

- He clicked on a promotional banner that was located on the website above a “Terms of Use” hyperlink;

- He clicked through pages of the website, selected products, and went to the checkout page where there was a “Go To Step #2″ button, under which was text stating that by clicking the button, a customer consented to receive email, calls, and texts;

- He clicked on the “Go To Step #2” button, entered his contact information, and purchased the products;

- He replied to an email from the company confirming his contact information.

The company argued that these steps constituted consent to arbitrate for three reasons.

First, the website was an enforceable “browserwrap agreement,” described as one that “provides a link to the terms and conditions and does not require the purchaser to click an acknowledgement during the checkout process.” The company explained that each page had a “Terms of Use” link which, if accessed, included the arbitration provision that “governed” the Messaging Program.

Second, the consumer entered into a “clickwrap agreement,” described as “an agreement in which a computer user agrees to the terms of an electronically displayed agreement by pointing the cursor to a particular location on the screen and then clicking.” The company “alleged that [the consumer’s] consent to the ‘Messaging Program’ served as consent to the ‘Terms of Use’ because the ‘Messaging Program’ was ‘governed by’ the ‘Terms of Use,’ which is where the arbitration agreement was located.”

Third, the consumer “double-opted into the arbitration agreement when he received an email prompting him to confirm his identity and agreement to receive [the company’s] marketing messages.” The company argued that the confirmation “served as consent to the ‘Terms of Use’ because it also enrolled him in the ‘Messaging Program’ which was ‘governed by’ the ‘Terms of Use.’”

The trial court denied the motion to arbitrate, rejecting each of the company’s theories, and the company appealed.

On appeal, the U.S. Court of Appeals for the Eleventh Circuit agreed with the trial court that the browserwrap argument failed because “the ‘Terms of Use’ hyperlink was easy to miss due to the distracting website and large green call-to-action buttons that were nowhere near the terms,” and “a reasonable person would not think to scroll down all the way to the bottom of a busy page, with large, green, call-to-action buttons, and notice a hyperlink that is in a small, white font.”

The Court also agreed with rejection of the clickwrap argument and explained that the “inquiry turns on whether the relevant terms were reasonably presented and whether the user took clear, affirmative steps to accept them.” Here, the “Go To Step #2” button only referenced consent to receive communications and failed to mention arbitration or the “Terms of Use.” “Nothing on the website informed users that clicking on any button manifested their assent to the ‘Terms of Use’ or the ‘Messaging Program,’” and “[b]y including an explicit consent to receive ‘emails, calls, and SMS text messages’ without mentioning arbitration, in fact, the ‘Go To Step #2’ button suggests the opposite of [the company’s] argument—i.e., that a website user was not consenting to arbitration by clicking ‘Go To Step #2.’”

The double opt-in argument fared no better, with the Court explaining that the company failed to present any evidence documenting what, if anything, the consumer consented to by confirming his contact information by email.

Thus, the Eleventh Circuit, in an unpublished opinion, affirmed the ruling of the trial court.

FCC Fines Company $1.5M Over Vendor Collection Agency’s Data Breach

In the Matter of Comcast Cable Communications, LLC

On November 24, 2025, the Federal Communication Commission (“FCC”) announced that it had entered into a Consent Decree with a company whose vendor, a collection agency, suffered a data breach that exposed the personally identifiable information (“PII”) of 237,702 of the company’s customers.

The FCC alleged the company violated Cable Act which:

- Prohibits cable operators from disclosing customers’ PII without consent, subject to certain exceptions (47 U.S.C. § 551(c)(1));

- Requires cable operators to take measures “necessary to prevent unauthorized access to such information by a person other than the subscriber or cable operator” (); and

- Requires cable operators to “destroy personally identifiable information if the information is no longer necessary for the purpose for which it was collected,” subject to certain exceptions (47 U.S.C. § 551(e)).

While the Consent Decree requires designation of a compliance officer to oversee the development and adoption of a compliance plan “designed to ensure future compliance with the terms of this Consent Decree,” including updating the employee compliance manual and supplementing employee training, the emphasis was on vendor management.

The Consent Decree requires the company to, among other things:

- Implement or take steps to enhance an existing data inventory program reasonably designed to accurately track subscriber PII shared with vendors;

- Contractually require vendors with access to subscriber sensitive personal information (“SPI”) to adhere to applicable requirements regarding the retention and deletion of subscriber SPI before granting access;

- Conduct biennial risk assessments reasonably designed to identify and assess risks to subscriber PII and SPI obtained by vendors and, based on the risks, require vendors to implement reasonable safeguards to control such risk and document the safeguards implemented; and

- Monitor vendors’ compliance with the company’s information security requirements as set forth in the vendor agreements, using assessments or reviews, so long as the business engagement remains active or the vendor continues to retain subscriber PII or SPI.

The Consent Decree also requires the company to report any material noncompliance with its terms to the FCC within 30 days, to regularly file detailed compliance reports, and to make a voluntary contribution of $1,500,000 to the U.S. Treasury.

Spend 5 minutes to get your Digital Readiness Score and help build the industry’s first Debt Collections Digital Readiness Benchmark. All data is anonymous. Survey closes Dec. 16.

After seeing a rise in Bankruptcy filings in October of 2025, we continued to see an increase in November of 2025. Typically, there is a lull towards the end of the year in the number of filings.

In October, EPIQ AACER reported a 7 percent increase from the prior year’s October filings. Subchapter V filings saw the greatest increase, rising 35% from the prior year. Consumer filings also saw an increase soaring to over 50,000 filings for the month. Chapter 7 filings increased by 14 percent and Chapter 13 filings saw an 11% increase. When comparing total bankruptcy filing from September of 2025, we saw an 8% increase. Chapter 11 filings in October were down 17% from the prior month.

In November, there was a 20% increase in commercial filings Chapter 11 filings as compared to November of the prior year. It is important to note that this increase was driven by related filings of certain parent companies. Subchapter V, small business reorganizations continued to rise from the prior year by 23%. The total number of commercial filings was up 8%. Filings dropped 18% when comparing October 2025 to November 2025.

The statistics provided come from the US Courts and EPIQ AACER. The RMAI Bankruptcy Working Group will continue to provide updates as to bankruptcy filing trends.

Donate an Item for the Annual Conference Silent Auction

RMAI is now accepting donations for the 2026 Annual Conference Silent Auction sponsored by Kino Financial Co., LLC. The silent auction will begin Tuesday, February 10th and will end during the Networking Reception on Wednesday, February 11th.

We are seeking 50 fantastic and unique items for the auction catalog. If you have an item you would like to donate, please complete this Donor Form. You can also view the auction catalog and register as a bidder on the Silent Auction webpage . We look forward to seeing some great donations!

Donate to the Legislative Fund with your Membership Renewal

December is the last month to renew your membership without a late fee, so now is a great time to pay and include your Legislative Fund donation with your renewal. Donating is voluntary and there is a suggested donation amount on your renewal invoice. Every donation to our Legislative Fund is appreciated and greatly helps us to continue the fight for the receivables management industry, so feel free to donate a different amount than suggested. If you’ve already paid your membership dues but would still like to contribute, you can do so by donating here.

About the Legislative Fund

RMAI actively monitors and responds to state and federal measures affecting how our members do business. Your contributions to the Legislative Fund extend the reach of RMAI’s advocacy across the country where and when needed. Read more about the Legislative Fund. Click here to see a list of current contributors.

Upcoming Webinars

Register for our December 18th, Ready or Not: New AI Laws Arrive Jan 1, 2026 webinar where our presenters will dissect the specific statutory and regulatory requirements as well as the critical steps your business must take to mitigate risk.

Register for the third webinar in our CCO Webinar Series on October 29th, Buildinga Risk Assessment and Audit Program Tailored to the Size and Scale of your Organization (Sponsored by ARM Compliance Business Solutions). Attendees will explore the distinctions between audit, both internal and external, monitoring, and risk assessments. Attendees will also learn how to evaluate and implement remediation programs in use today by their industry compliance peers.

Recorded Webinar

Recorded on November 19, 2025 you can register for Optimizing Debt Collection and Probate Processes: Best Practices, Auditing Strategies, and Process Improvements where our presenters will explore the complexities of debt collection within probate processes, focusing on effective strategies and best practices, and will discuss essential techniques for managing and settling debts, conduct thorough audits of probate procedures, and identify ways to optimize and streamline the entire process for you and your clients.

Chief Compliance Officer Webinar Series (Package or Individual)

The Chief Compliance Officer Webinar Series package includes five courses focusing on developing and maintaining your compliance program within your company. You can Register for all five (5) or pick and choose individual courses.

#1. RECORDED Register From Paper to Practice: Building Policies & Procedures that Protect, Perform, and Prevail (Receive as a recording when package is purchased)

#2. RECORDED Register From Mandate to Motivation: Building a Risk-Proof and Engaging Compliance Training Program (Receive as a recording when package is purchased)

#3. RECORDED Register Building a Risk Assessment and Audit Program Tailored to the Size and Scale of your Organization (Receive as a recording when package is purchased)

#4. RECORDED Register From Onboarding to Offboarding: Building Rock-Solid Vendor Partnerships in Collections (Receive as a recording when package is purchased)

#5. RECORDED Register A CCO’s Guide to Impactful Board and Executive Reporting – December 5, 2025

To see full descriptions of each webinar check out our website by clicking this link.

Pricing: Package | Member: $200 | Non-Member: $350

Pricing: Individual | Member: $64 | Non-Member: $94

Click here for more information on our live and recorded educational webinars. Contact Shannon Parod-Tsui at [email protected] to find out more about sponsoring an RMAI webinar.

Congratulations to our new and renewed Certified Receivables Compliance Professionals (CRCP) & renewed Certified Receivables Businesses (CRB)!

CRCP NEW

Elise Pierce, FMA Alliance

Jes Villa, Second Round

CRCP RENEWALS

Anthony Bacon-Cox, Southwood Financial

Andrew Hagerman, Unifund CCR LLC

Kenneth Hamill, Resurgent Holdings

Jeff Hasenmiller, D&A Services

Kay Myers, Resurgent Holdings

Jim Prawel, Independence Capital Recovery

Peter Ragan, Ragan & Ragan Law

CRB RENEWALS

Genesis Recovery Services

NCB Management Services

The Cadle Company

View all certified businesses and vendors.

View all certified individuals.

Start Planning Your Education at the 2026 Annual Conference

For individuals who are looking to earn their Certified Receivables Compliance Professional (CRCP) designation, the Annual Conference will be offering up to 16 education credits which can be used towards your CRCP certification.

For currently certified individuals, especially those in the role of Chief Compliance Officer for a certified business, it is a requirement that you earn at least 12 in-person credits every two (2) years. If you haven’t earned any in-person credits yet, please make sure you allow for attendance at either and RMAI conference or other industry conference.

Take a look at our agenda and start planning now. Highlights include:

- Two (2) of our three (3) required courses will be on Tuesday, February 10th starting at 8am.

- Introductory Survey Course on Receivables Management (earns 4 credits)

- Ethics as the Cornerstone of a Compliance Management System (earns 2 credits)

Contact Shannon Parod-Tsui @ [email protected] or call 916-482-2590.

View our full list of certification resources.

Reminder to Renew for 2026!

If you have not yet renewed your membership for 2026, it’s not too late! Renew before December 31 to avoid the $100 late fee and continue to receive access to your membership benefits. If you have completed your registration for the 2026 Annual Conference, or are planning to attend, you must have an active membership at the time of the conference to take advantage of your member rate, so don’t miss out! To pay your invoice, please login here. If you require assistance, please call the RMAI office at (916) 482-2462 or email [email protected]. To those who have already renewed their membership for 2026, we thank you for your continued support and are looking forward to another great year together.

RMAI Annual Conference First Time Attendee – New Member Zoom

During this interactive Zoom meeting, we will offer insight into how to prepare for the 2026 Annual Conference, share best practices and tips for maximizing your experience, and answer your questions about RMAI and the 2026 Annual Conference. Invitations will be sent out on December 19, so keep an eye on your inbox.

Network with Other RMAI Members via the Member Directory

A key benefit of your RMAI membership is networking with other members. Take advantage of the online Member Directory and sort by Member Type or State or search using keywords or for a specific company’s name. Make new connections ahead of RMAI’s 2026 Annual Conference to maximize your time there. Login to start networking!

Welcome New Members

Industry Management Systems, LLC| NY

Navient Solutions LLC | VA

Veritus Financial LLC | CA

For a complete list of RMAI members, login to check out the Member Directory.

2026 RMAI Annual Conference | February 9-12, 2026

LEGISLATIVE FUND CONTRIBUTORS DECEMBER 11, 2024 – DECEMBER 11, 2025

DIAMOND

Absolute Resolutions Corp.

Cavalry Investments, LLC

Crown Asset Management, LLC

Midland Credit Management

PRA Group, Inc.

Resurgent Holdings, LLC

Second Round, LP

Velocity Portfolio Group, Inc.

TITANIUM

Financial Recovery Services, Inc.

TRAKAmerica

PLATINUM

Blitt and Gaines, P.C.

Cascade365 Family of Companies

Halsted Financial Services, LLC

InvestiNet, LLC

Pharus Funding, LLC

Plaza Services

Rausch Sturm, LLP

Stenger & Stenger P.C.

T & I Enterprises, LLC

TrueAccord

GOLD

Klima, Peters & Daly, P.A.

SILVER

Andreu, Palma, Lavin & Solis, PLLC

Central Portfolio Control, Inc

D & A Services, LLC

DebtNext Software, LLC

Jefferson Capital Systems, LLC

Pressler, Felt and Warshaw, LLP

Security Credit Services, LLC

Velo Law Office

BRONZE

Couch Lambert

MauriceWutscher LLP

Stillman Law Office

Tromberg, Miller, Morris & Partners, PLLC

BRASS

Advancial Federal Credit Union

AgreeYa Solutions, Inc.

Aldridge Pite Haan, LLP

American Coradius International LLC

ARM Compliance Business Solutions LLC

Balbec Capital

Bankrupt Debt Services

Bread Financial

Buffaloe & Vallejo, PLC

Call Center Services International

CASA Receivables Management, LLC

CBE Companies

Cedar Global Solutions LLC dba Remote Scouts

Channel Payments, Inc.

CMS Services

Collection Attorneys USA LLC

CompuMail Information Systems

Connect International

ConServe

Cornerstone Licensing Services

Credit Brokers LLC

Credit Control, LLC

FDR Alliance LLC

FLOCK Specialty Finance

FMA Alliance, Ltd

FMS, Inc.

ForgiveCo PBC Inc

Reynolds Sims & Associates, P.C.

Genesis Recovery Services

Gordon, Aylworth & Tami, P.C.

Grassy Sprain Group, Inc

Guglielmo & Associates, PLLC

InterProse

Invenio Financial, a Phillips & Cohen Associates company

Kino Financial Co., LLC

LexisNexis Risk Solutions

Mandarich Law Group LLP

Markoff Law LLC

Moss & Barnett, P.A.

National Enterprise Systems, Inc.

National Loan Exchange, Inc.

National Recovery Associates, Inc.

NCB Management Services, Inc.

Nutun CX (PTY) LTD

Orbita Capital Group, LLC

PaymentVision (Autoscribe)

PCI Group Inc.

Premier Bankcard

Premium Asset Recovery Corp (PARC)

Primeritus Financial Services, Inc.

Quality Acceptance

Remitter

Revenue Assistance Corporation dba Revenue Group

RevSpring

Risk Strategies

Robinson Hoover & Fudge, PLLC

Roosen, Varchetti & Olivier, PLLC

SAM – Solutions for Account Management, Inc.

Scott & Associates, PC

Shepherd Outsourcing, LLC

Smith Debnam Narron Drake Saintsing & Myers, LLP

Stone Creek Financial Inc.

Stone, Higgs & Drexler

Superlative RM

Suttell & Hammer

The Cadle Company

The Forwarders List of Attorneys

The Law Offices of Ronald S. Canter, LLC

The Moore Law Group

The Oakes Law Firm, LLC

Troy Capital, LLC

VeriFacts, LLC.

Vertican Technologies, Inc.

Womble Bond Dickinson

Yrefy, LLC

OTHER

Alliance Credit Services, Inc.

Bedard Law Group, P.C.

Ceteris Portfolio Services LLC dba J.J. Marshall & Associates

Cohen & Cohen Law, LLC

Complete Credit Solutions, Inc.

Consuegra & Duffy, PLLC

Convoke, Inc.

D1AL

Debt Sales Partners

Denali Capital, LLC

First National Collection Bureau

Frost Echols LLC

Hilco Receivables, LLC

London & London

Sonnek & Goldblatt, Ltd.

Tavelli Co., Inc. dba Tavco Credit Services

UHG I LLC

Vargo & Janson, P.C.