Monetizing Equity and Transferring Ownership with Strategic Impact

By Michael Flock, Flock Advisors

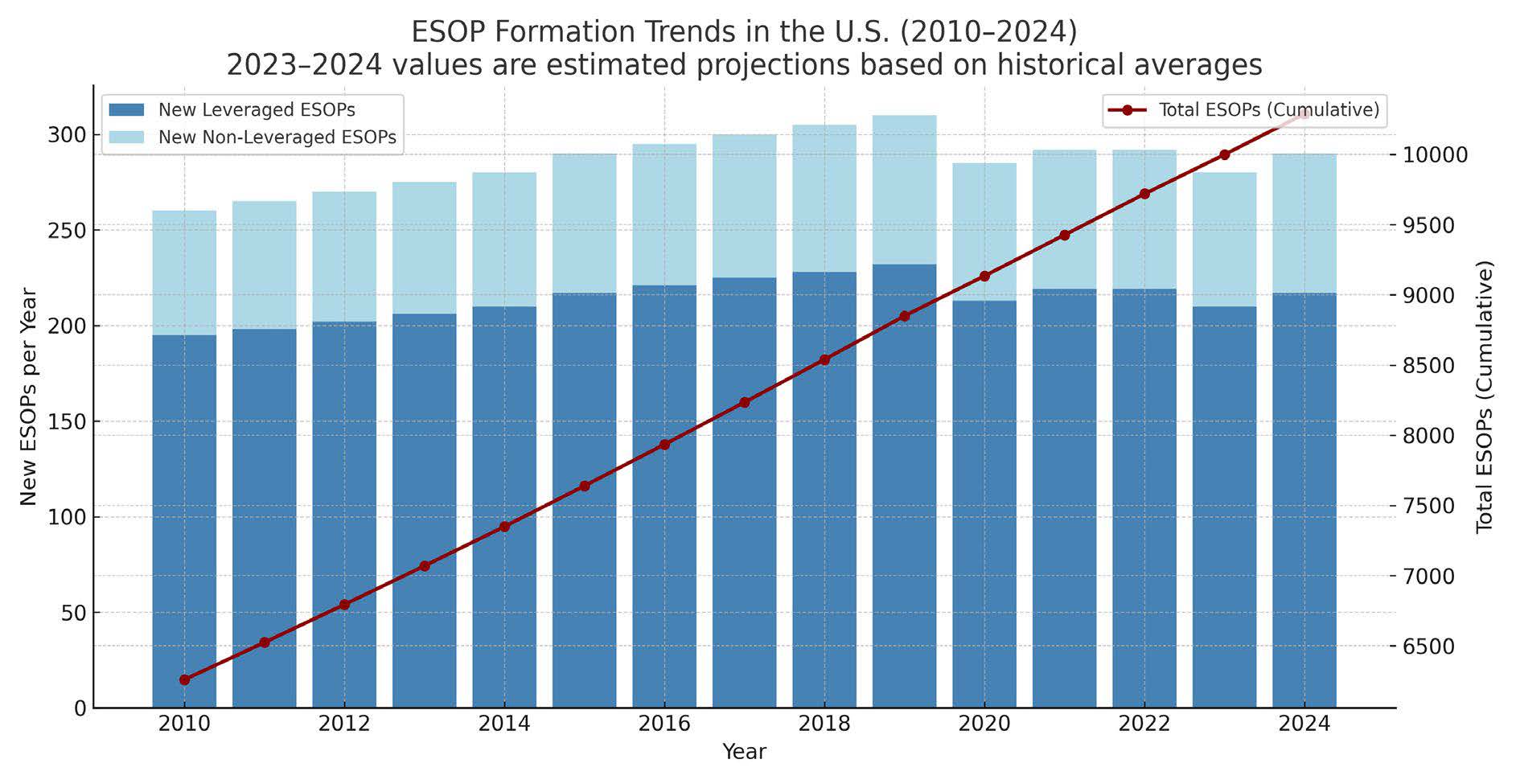

Note: Historic data and 2023–2024 projections are based on historical ESOP formation trends and market estimates. Data sourced from NCEO, National Center for Employee Ownership, the ESOP Association, and industry research.

Most people have no idea what an ESOP is, let alone what the acronym stands for: Employee Stock Ownership Plan. Many believe it’s simply an arcane government program meant to encourage employee ownership.

But few truly understand how ESOPs work. Even fewer realize that a leveraged ESOP is a powerful and creative way to recapitalize a business and transfer ownership on a tax-advantaged basis, benefiting both sellers and buyers. In times of economic uncertainty, when private equity valuations are depressed and strategic buyers hold all the cards, ESOPs can offer a compelling alternative.

If a shareholder sells 30% or more of a company to an ESOP, they may defer capital gains taxes—potentially permanently, if structured properly. Typically, the ESOP obtains bank financing to fund the purchase, although sometimes seller notes are used for funding.

A trustee is appointed to represent the ESOP, and a third-party valuation firm validates the fairness of the purchase price. Because the equity sold to the ESOP is often preferred stock, and due to tax advantages, ESOPs frequently result in higher valuations than what private equity firms offer. Sellers can choose to retain control or transition it to management. Unlike a sale to a third party, the ESOP process is typically faster, more confidential, and more predictable. As the graph above illustrates, ESOPs have grown rapidly and bounced back with resilience after the pandemic.

A powerful example comes from Plaza Associates, a former New York-based collection agency. Owned by three aging shareholders, the company had repeatedly attempted to sell to private equity and industry buyers. Each time, the deals fell through—due to valuation gaps, financing hurdles, personality conflicts, or buyer conditions.

After a comprehensive review of Plaza’s financials, market position, and management strength, Flock Advisors determined that a leveraged ESOP offered the best path forward:

• Federal tax savings of permanently deferred made the valuation more attractive to sellers.

• The management team was incentivized with additional equity and excited to gain control.

• Because ESOP debt is tax-deductible, Plaza wouldn’t pay taxes until the seller notes were repaid, effectively reducing the purchase cost.

• Sellers and management jointly controlled the process, improving alignment and execution.

Crucially, a national ESOP attorney with deep M&A and ESOP expertise helped navigate the transaction’s complexity and resolve sensitive issues. Simultaneously, Flock Advisors conducted a competitive financing process, soliciting term sheets from multiple banks and ultimately securing favorable terms without personal guarantees.

While aligning the three owners wasn’t easy, flexibility in deal structure helped address concerns around liquidity and rights. In the end, the deal closed within four months. After nearly 50 years, the owners exited on their terms, and the management team took full control with enthusiasm.

Paul Brennan, CEO of Plaza at the time said: “ESOPs were the best option for the three founders who had no appetite for an arduous journey with private equity funds, or selling to a strategic buyer, and Plaza management wanted equity. Michael Flock and his team ran an outstanding process and navigated through a maze of conflicting interests of the owners, employees, and the banks., and negotiated so everyone came out as a winner.”

So ESOPS can be an excellent equity solution to monetize equity and transfer ownership through a timely, fair, and creative way. With the right advisors, you can structure a transaction that meets your financial goals and rewards your employees. ESOPs can enable you to have your cake and eat it too. Yes, you can.